Today’s a holiday in Hong Kong so I thought I’d spend some time to catch up with how the New Economy Speculative Complex And Related (NESCAR) sector has been doing.

To remind, my go-to indicator is an index compiled by Goldman Sachs in 2021 of highly valued loss making companies which I wrote about in April flagging then potential for further losses (NESCAR April Update). That group has suffered the further losses predicted and I’ll have a full update on the ongoing carnage next month i.e. six-months from the last review. [Now done (October 8th) and posted here at The Final Word]

Today though I wanted to give some thought to how long a rout in this over-invested style might go on for and, in the process, consider how long the ‘value’ style, now in the ascendant, might persist?

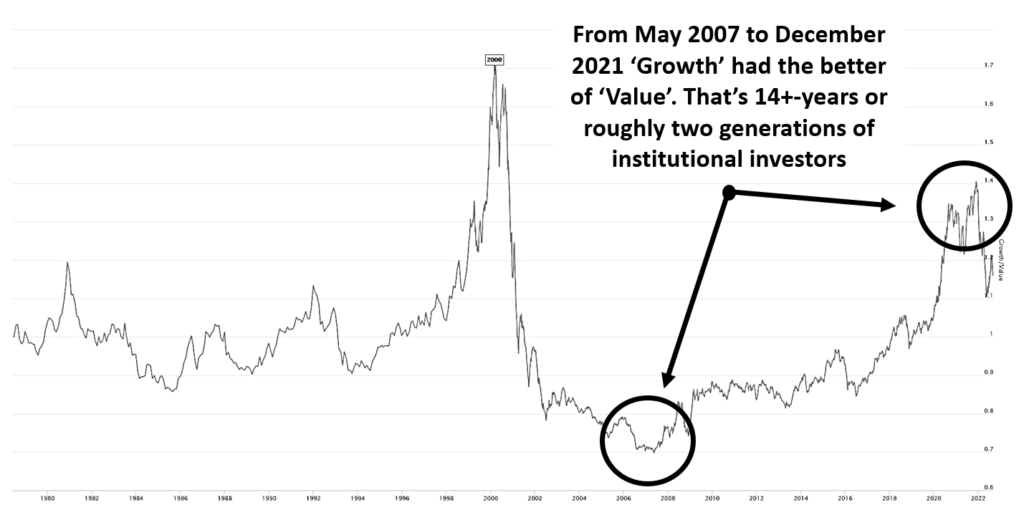

[Below I’m using for illustration the Wilshire Growth/Value Index of U.S. stocks which I believe is a reliable cipher for global and more specifically China stock trends. You’ll find details here Wilshire Growth/Value]

First, it’d help to have a look at how long ‘growth’ has been an in-vogue style in the most recent cycle. The chart below shows the Wilshire Growth/Value index for the last 44-years.

From the trough in 2007 to the peak in 2021 we see growth as the persistent out-performer; that’s more than one lifetime in market-years.

From the same chart we also see three distinct peaks prior to the most recent; in November 1980, in December 1991 and the mother of them all, in March 2000.

The average life of each correction following a peak (excluding the most recent) comes out at just over 4.5-years but, with such a small data-set, I don’t think that tells us a whole lot so, analysis from this point has to proceed based on intuition.

The run up prior to the mother of all collapses, from March 2000, began in September 1993 so was around 6.5-years or less than half the life of the run up to our most recent high in December 2021.

Thus, the big difference between then and now is how deeply invested, and how large, the cohort with the notion that growth-investing is the right and proper way to go about deploying long-term capital is.

Back in 2000 opinions were divided and the growth-collapse occurred with much I-told-you so-ing from a large recalcitrant value crowd; but this time it’s different. There’s no* recalcitrant value crowd.

[*There are, of course, a few of us but we’re a tiny minority, for now.]

It hasn’t been possible to be an institutional investor, and keep your job, for over a decade without being on the growth bandwagon. If we look today at the top holdings of ANY institutional China fund we see the same five or six growth-tech-new-economy names they were holding 3-years ago despite many of them having halved in value from peaks.

A look at the U.S. reveals dozens of loss making enterprises with still absurd market capitalizations and many barely profitable enterprises in the same barking-valuation camp. Cryptocurrencies, although significantly re-priced this year, continue to attract interest despite being neither currencies nor reliable value stores; and so on.

What do I conclude from all this? That the growth vs. value push-pull is now in value’s favor; BUT the growth crowd are very reluctantly walking away from soured bets; because they don’t know what else to do.

Moreover, despite wounds they’re still a force and able to muster liquidity from time to time which will continue to result in powerful counter-rallies in assets (like crypto) that are, nonetheless, in a long-term style downtrend.

The bottom line. Growth as an investing style is in long term decline but, due to the length of time it spent in an ascendant, will under-perform value over a longer time than in previous cycles.

This time around, there’ll be no short nor sharp shock for growth investors. Instead, a long-term cyclical downtrend will be punctuated by occasional rallies fueled by these operators familiar with generations of success, but incapable of learning the new game.

Nial Gooding

Monday, September 12th 2022