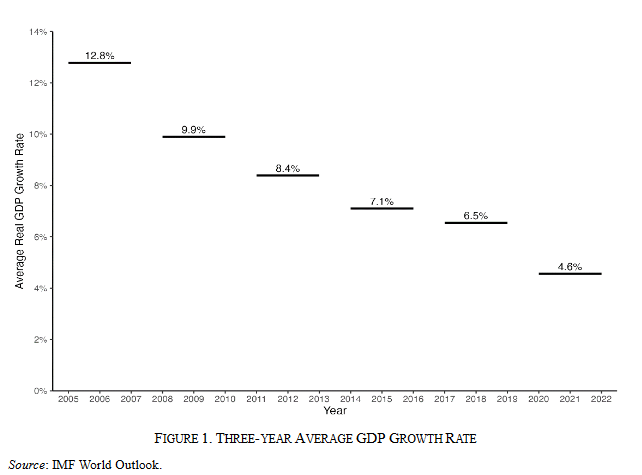

There’s no argument about whether or not China’s GDP growth rate has slowed (above). Professor Barry Eichgreen from the Department of Economics at the University of California at Berkley (writing in the KDI Journal of Economic Policy) wants to go deeper into the cause(s).

The professor decided to test seven popular hypothesis about the reason(s) for China’s slowdown. They are:

- Demography, specifically a shrinking labor force

- Progress into the ‘middle-income trap’, like some Asian neighbors

- Diminishing returns to the export-debt-investment model

- Political heavy handedness and endless crackdowns on corruption etc.

- U.S. export controls limiting access to higher technologies

- Reluctance by a government to intervene worried by indebtedness

- The rise of household and corporate debt

The paper dips into more detail on each of the above and concludes they’re all relevant to the slowdown discussion.

However some, such as the demographic, political and trade constraint factors are probably weaker influences than others.

Professor Eichgreen’s prescription-conclusion is similar to other observers, most recently the IMF, who’ve highlighted the need to get households more enthusiastically into the consumption mix (at the same time local authority indebtedness and old build-it-and-they-will-come industrial policies need to be reined in).

The fix on the consumer dynamic is easier said than done when the more affluent members of Chinese society are reeling from the significant wealth-reduction-effect that lower property prices have engineered.

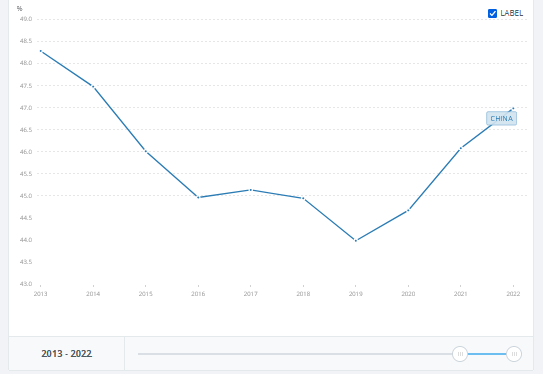

The government’s flubbed COVID exit also reminded many of the benefit of precautionary savings. So these, which the Prof. and the government would like to see falling have, recently and in fact, been rising (below).

[This is China’s Gross Domestic Savings (% of GDP) from the World Bank up to 2022, I’d wager 2023 was higher.]

Looks like the Chinese economy could be thrashing in the shallows a while longer if this analysis is anything to go by.

The paper is a short, well written read and available in full here China’s Slowdown.

Happy Sunday.