Françoise Huang (et al.), Senior Economist for Asia Pacific and Trade writing in an Allianz Research paper revisits the notion that the Chinese Renminbi (Rmb) may be heading to a position of ‘co-hegemony’ with the U.S. Dollar (U$).

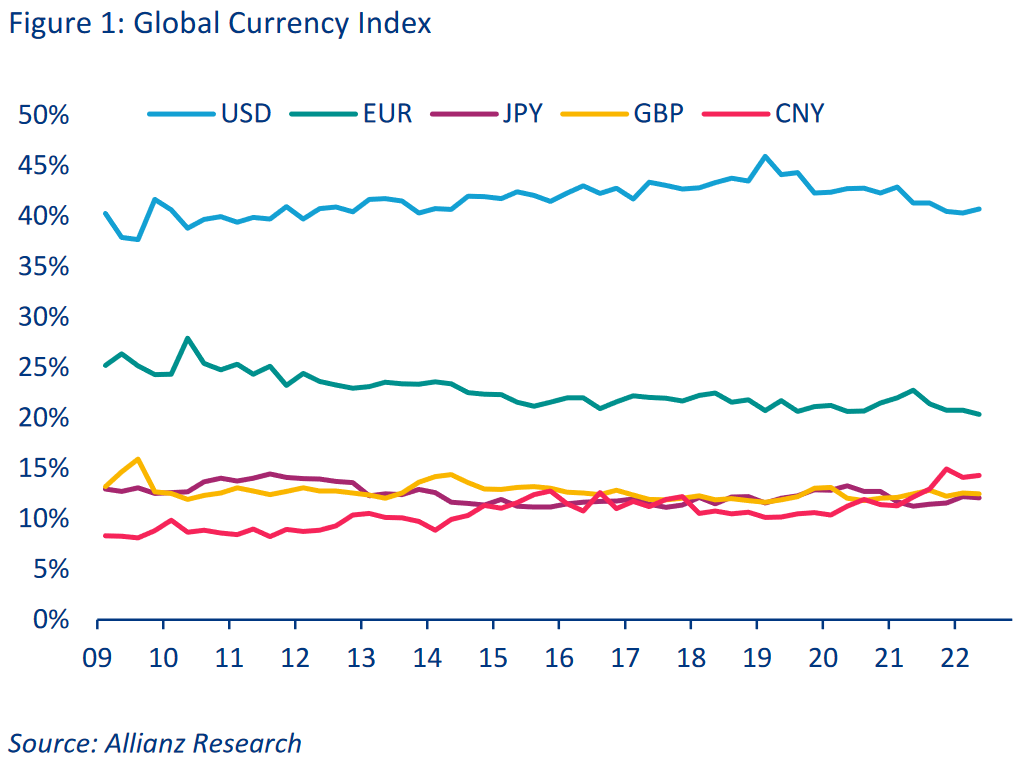

The brief begins by noting since 2009 the influence of the Rmb has doubled in size in the global financial system nudging ahead of the Japanese Yen and the British Pound (but still behind the Euro).

However, a look at the chart below shows why a move to rival the U$ will take much longer, if it’s possible at all [These are Allianz-proprietary composite indices based on factors relating to currency’s overall clout].

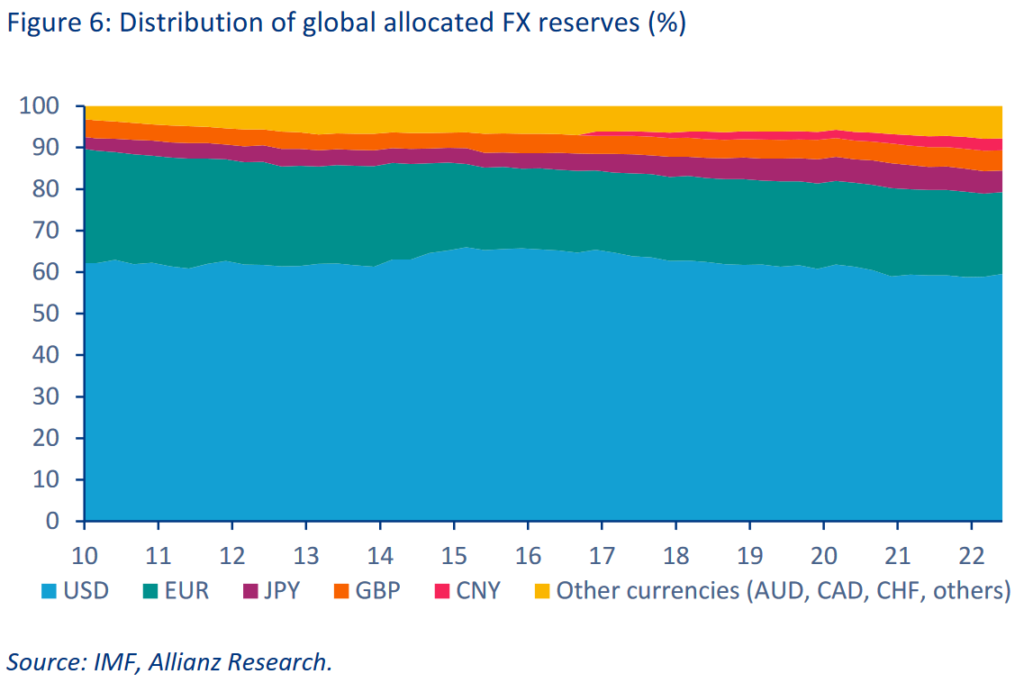

Moreover, even a move to co-hegemony seems unlikely even if global trade settles into a U$ and an Rmb block. This is because, despite an early noughties spurt, China has scaled back financial reform and further liberalization appears to be slow.

A look at the picture on global currency reserves further makes the point about the distance needed to catch up, let alone surpass the U$.

Finally, the note concludes more impetus than is currently visible would be required from not only global institutions like the World Bank but also the People’s Bank of China to foster wider Renminbi acceptance.

In summary, China seems happy to see a growing internationalization of the Rmb but is content, for the time being at least, to cross this river whilst feeling for the stones (摸着石头过河, mō zhe shítou guò hé).

You can read the full note (12-pages) via this link Financial Globalization: Moving Towards a Polarized System?

Happy Sunday.