[As the last W-share listed behemoth to flirt with its listing price flails (Meituan 03690, September 2018, H$69.00, others are well through) brief thoughts on the process of listing companies that once touted poor corporate governance i.e. Weighted Voting Rights, as a virtue. It wasn’t then, it isn’t now.]

The decision taken by the Hong Kong Stock Exchange in April 2018 to allow so-called ‘Weighted Voting Rights’ companies to list was a bad one. This isn’t just my opinion, it’s a fact in plain and ugly sight now.

It wasn’t a bad decision, in the short term*, for the Exchange, underwriters, reporting accountants, lawyers, and the Uncle-Tom-Cobley-and-all of service providers who subsequently collected a mountain of fees.

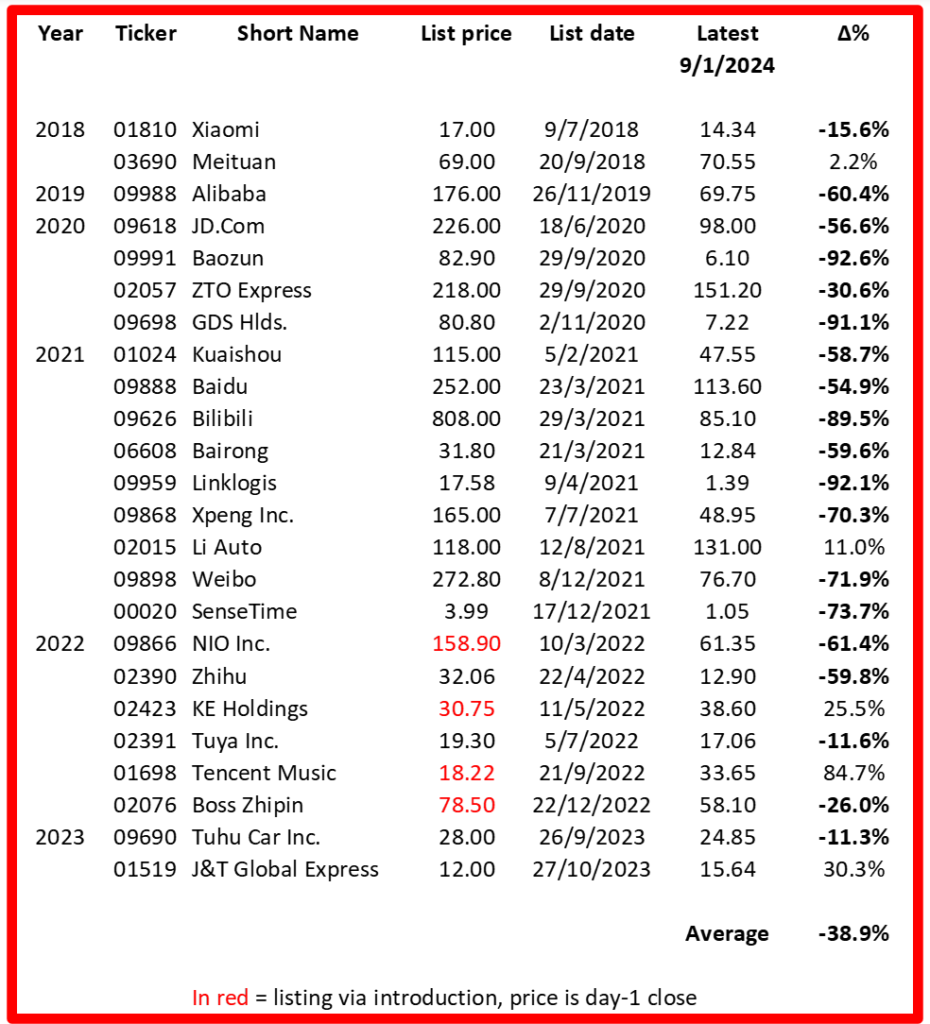

For investors however, the stock price performance of these companies subsequent to listing has been a disaster as the table below shows.

[Table: HKEX W-share listings, all. Data: HKEX. This is the kindest possible analysis as I’ve chosen not to present market-capitalization-weighted losses. The method of presentation though is, sort of, irrelevant; however you cut the data the value/capital destruction in this process has been vast.]

In addition to the first-order investor damage the collateral damage* to the aggregate Hong Kong market valuation level as these company’s stocks plunged has turned Hong Kong into one of the least attractive major world stock markets for new issuers.

In response to this dearth of new listings Messrs Cobley and friends are now complaining it’s the existing Listing Rules that are preventing new IPOs and the solution is to allow even shabbier prospects to list. Yes, seriously.

IMHO, this is like an alcoholic suggesting their inability to function could be cured by more, but in future stronger, grog.

If there are no ‘good’ companies that wish to list for a while, so be it. A hiatus of new listings, not more flimsily constructed concept-stocks, would now be of the greatest service to investors and, ultimately, Hong Kong Inc.

Nial Gooding

Wednesday, January 10th 2024