A brief personal preamble. I maintain Chinese banks are among the best run and safest financial enterprises in the world. This view is incontrovertible in only one circumstance i.e. you believe they falsify their numbers. The fact many do explains the multi-year drubbing valuations have suffered.

Eventually though, the negative assumptions will be discovered to be true or the validity of such views will be undermined by the persistence of steady returns, a very important and tangible one being dividends.

The paper highlighted today from Xingxi Ren (et al.) at the Capital University (Ohio, U.S.) seems to confront naysayers by highlighting the progress that ‘digital transformation’ (DT) has had on sector profitability over their study period of 2014~2020.

The researchers used a proprietary ‘digital transformation index’ which allowed them to look beyond just progress of fintech initiatives and consider banks holistic approach to DT.

Not only did they note a significant improvement over the period in revenue due to DT but a reduction in costs due to other DT effects which produced the ‘profitefficiency’ gains they refer to in the title of their work.

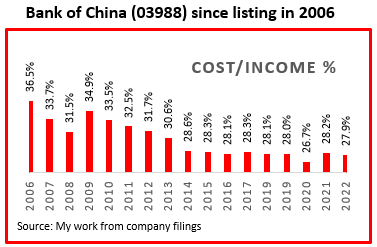

I’ve wondered how Chinese banks have managed to keep cost/income ratios so steady in recent years and I guess this is part of the answer?

[The global banking average according to a study by McKinsey last October was 52%.]

A final point is that profitefficiency gains were most pronounced in banks with higher ownership concentrations. This suggests manager recalcitrance to change can be mitigated by a robust control structure.

A lesson bank managers elsewhere in the world will be alive to but many are able to do much about, CSFB anyone?.

The paper in full is here Does Digital Transformation Increase Bank Profitefficiency?

Happy Sunday.