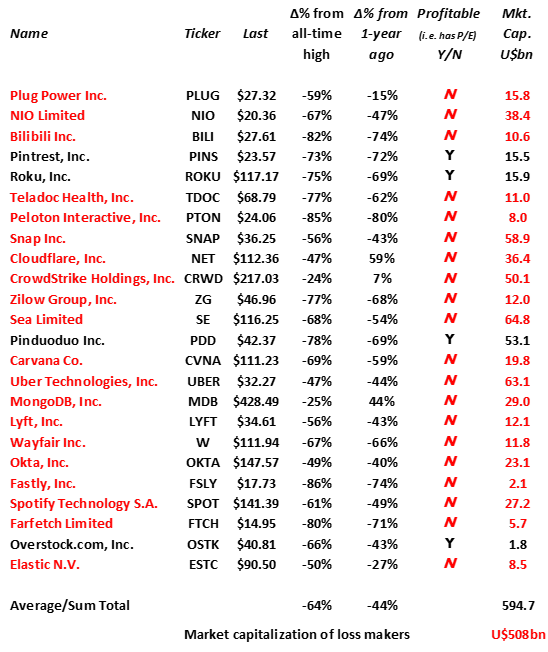

A year ago I took a look at the components of an index of unprofitable new-economy companies Goldman Sachs put together in early 2021. [NESCAR Watch – Slow Pile Up: So Far]

I described these stocks then as a window into a much bigger group, the New-Economy Speculative Complex And Related (NESCAR).

Since then we all know what’s happened. Particularly in the China space.

What interests me now is not how much these names are down from a) their all-time highs and/or, b) from this time last year.

What struck me when looking again at this group was the still sizeable market capitalizations enjoyed by the many that remain unprofitable.

To remind, the value of an unprofitable enterprise is something less than its assets. If it has no assets, which describes many in NESCAR-land, it’s value may not be zero, but can’t be far above.

Stocks highlighted below therefore, of companies with large market capitalizations but no profits, must be at risk of further significant declines.

Here’s the full list from last year updated with yesterday’s (7/4/2022) closing prices. (Last year’s list was priced on 9/4/2021, this year we’re minus only Slack (WORK) which was taken over by Salesforce (CRM)).

Note: All data from Yahoo Finance (YF). Performance does not include dividends, if any. Profitability is determined by whether or not a P/E number appears at YF, there’s no adjustment for prospects.

From this list alone we find a total capitalization of over half a trillion dollars associated with still unprofitable enterprises; and this is just a window into the bigger total NESCAR-unprofitable-foolishness.

With interest rates headed unequivocally higher any talk of a bottoming-out or the chance to buy-on-weakness for stocks in this group would seem then, to me at least, to be premature.

Nial Gooding

Friday, April 8th 2022