That China’s domestic stock markets (that increasingly set the tone in Hong Kong) differ fundamentally in terms of players and tactics from developed markets is not new news.

However, Lin Tan (et al.), from the Tsinghua University has produced a meta-study looking not only at how the players differ but also how their tendencies manifest themselves.

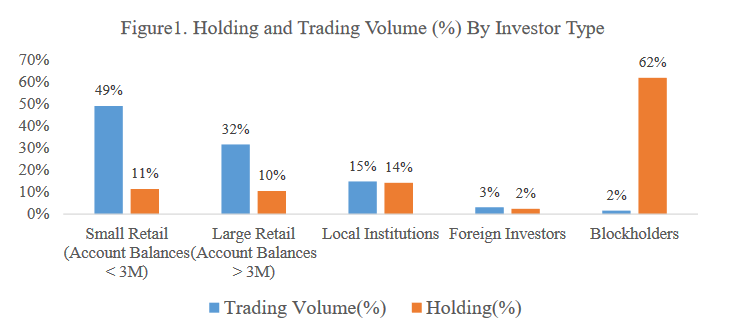

This extract from the paper highlights the importance of retail participants and the dead-weight of immobile holders versus the total market capitalization. It also illustrates that foreigners remain, for the time being at least, a rounding error in terms of total participation.

The paper has four key findings:

- Retail players suffer from low financial literacy, exhibit behavioral biases and reliably negatively predict future returns.

- Institutional players (including foreigners) are capable of processing information and use this ability to better predict future returns.

- The macro and firm-level information environment in China is steadily improving. A useful aside here. In 2010 China required financial analysts to be registered. In 2011 there were 1,958 professionals booked, by 2021 the number had grown to 3,588 a CAGR of 6%.

- Government policy results in regulatory changes aimed at maintaining ‘growth and stability’. These efforts have been, on the whole successful.

The researchers conclude noting the increasing heft of institutional players and believe more attention should be paid to their habits as they’re likely to most affect the future course of China’s stock market’s behavior.

IMHO, they’re missing the more obvious and immediate conclusion i.e. if retail investors dominate presently and they have a reliable habit of being wrong about future returns then the depressed valuations now the norm among China stocks must represent an opportunity; but I would say that wouldn’t I? 😉

You can access the paper in full via this link Retail and Institutional Trading Behaviors.

Happy Sunday.