The world’s two largest economies offer different scenarios for stock investors into the second half of 2022; one can now either:

a) invest in an uncertain economy where recession may occur; but if it doesn’t an ongoing reckoning of profligate and inflationary government policies, deleterious to corporate earnings growth, will continue. Or,

b) invest in a certain one where a steady recovery from self-induced economic retardation will continue and where inflation (its absence, to be clear) is unlikely to impede corporate earnings progress.

Hmmm. While we ponder, I’d like to digress on valuation.

In the uncertain option, stocks (the S+P-500) in aggregate now trade on around 20x earnings. Not expensive relative to history, and a lot cheaper than they’ve been recently. However, a glance at the future suggests the next iteration of forward earnings’ guesses will be lower.

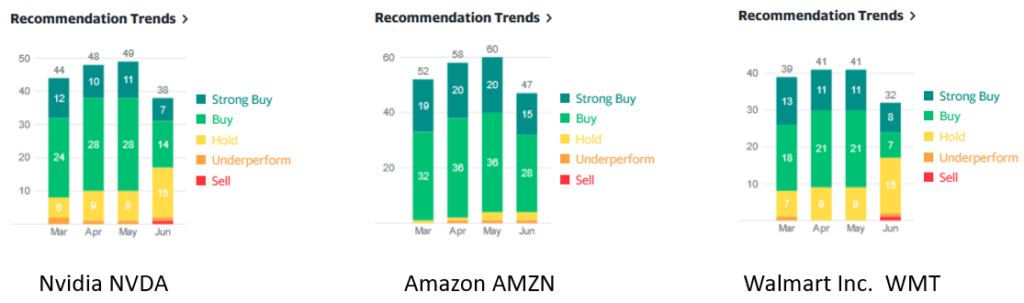

I’ve picked three household names below, representing different segments of the U.S. economy, for illustration.

The forward P/E therefore for option a), as behind-the-curve analysts reduce forecast-Es, will rise. In the process today’s ‘fair’ valuation will become less so; option b) is a different story.

There, the most representative and investable basket of China stocks is expressed by The Hang Seng China Enterprises Index (HSCEI) which now trades on a P/E of c.10x. Half the ‘Quick Recession, Maybe’ alternative which, as noted, is likely rise.

It gets better. The HSCEI contains several new-economy heavyweights. If these are looked past a hard core of blue-chip China market-leaders appear with an even lower aggregate valuation.

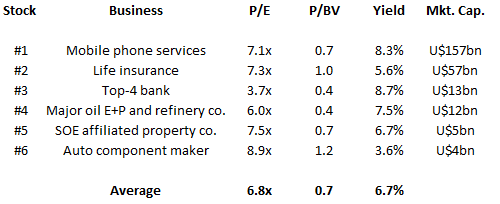

Below is a list of just six examples (in which I have no economic interest). This real-world mini-portfolio of market leading Chinese companies is composed of enterprises that’ll all be around in 5-years time and most (all?) of which will then have higher earnings.

To remind, these firms are major players in plain sight in a market where only the trajectory of top-line economic growth is moot.

Moreover, and if pressed, I* can finger at least 20-more companies listed in Hong Kong with similar size/valuation characteristics.

[*So could you. Throw a rock into the Hong Kong market presently, avoiding the new-economy, and you can’t fail to hit them.]

Back to the big question; how would global stock investors be best positioned going into H222? In a dear versus cheap market? Long uncertainty or stability? Owning rising or falling risks?

The answer, to me at least, is crystal clear; and rarely does an argument, and its conclusion, present itself so naturally or compellingly.

Nial Gooding

Monday, June 27th 2022