Preamble

China stock investors have had a rum time of it in recent years. Capricious government policies, on both the macro and micro level, have caused multi-year investor pain and fomented a climate of rolling uncertainty.

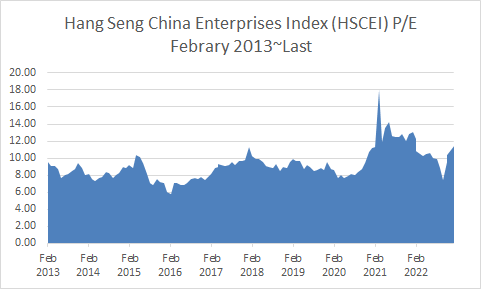

This, in turn, has led to an exodus of liquidity and largely explains the more-than-decade-long cycle of depressed valuation you see below.

[N.B. The spike, in late 2020, and subsequent hump was due to new-economy heavyweight inclusion. The process has blighted this and a number of other indices as those stocks were introduced at prices/valuations unlikely to be seen again.]

Summary Conclusion

A quintet of factors should persuade investors towards a more constructive view of China investment as 2023 progresses.

If this potential becomes reality the process will exert upward pressure on the valuation of all China assets, of which the prices of many* Chinese company stocks will be obvious beneficiaries.

[* Not all, several new-economy behemoths are convulsed with issues specific to them which will take years to resolve.]

To be clear, this isn’t prediction; it is nonetheless a summary of what I think are highly likely outcomes.

Any of these factors could be material; but if they show up in combination the cumulative effect will be dramatic.

The Quintet

Below I’ll be brief. One could produce a monograph on each but as I’m fingering potential events I don’t want to get into longer arguments. These things will happen, or they won’t.

1. Sentiment Towards China Will Improve

Could it get worse? This just in from Reuters on Saturday, February 25th; “Analysis: Investors wary of Chinese assets as political risk ramps up”. The mainstream media have recently had an errant observation balloon and a scare China might provide Russia with kit for their war with Ukraine to fan anti-Chinese hysteria with. Events preceding, we’re all too familiar with.

Behind the headlines I see China working harder to improve relations with the international community. In January it signed a significant deal with the Philippines on maritime protocols. Prior to ‘Balloongate’ it was reaching out to the U.S. (and most likely will again soon). Earlier this month it received a delegation from Taiwan’s main opposition party and Taiwan subsequently received a delegation from Shanghai which was described as a ‘rare’ event and the first of its kind since 2020. Last week China and Japan held their first formal security talks for four years and most recently it’s presented what appears to be a genuine attempt to provided mediation in the Russia-Ukraine conflict.

Some will here scoff; but the above is not nothing. If China keeps up it’s regional dialogues and continues to support Russia via commerce alone the scope for a less harsh analysis of it’s broader objectives is significant.

I don’t expect China to become liked, but it could become less disliked and that may be all that’s required to affect a useful sentimental shift.

2. China’s Economy Will Grow Strongly This Year

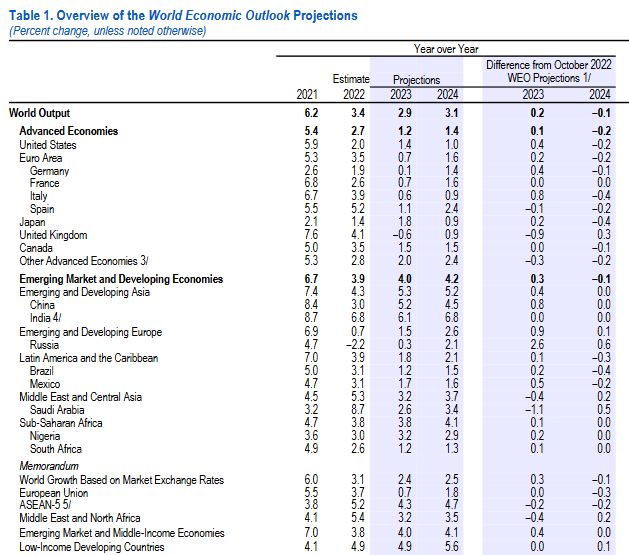

The IMF set the ball rolling on 2023 GDP growth forecast updates by raising their 2023 guess in late January to +5.2%.

If you look to the right you’ll see China was also the recipient of one of the biggest upward rethinks from last October.

The year has just begun and experience teaches us then when a trend like this starts it’s often persistent. The extract below from a February 9th article from MarketWatch underscores the point:

“Banks including Nomura, as well as rating firms including Fitch Ratings, have revised up their projections for Chinese economic growth in recent weeks.

Nomura now expects China’s 2023 economic growth at 5.3%, up from its previous 4.8% estimate, while Geneva-based Union Bancaire Privée raised its forecast to 6% from 5.2%. Moody’s Analytics raised its forecast to 4.9% from 4.3%, while Fitch expects an economic expansion of 5.0%, up from ..4.1% growth.”

The Chinese government, post COVID, must get the economy moving and as a result the recovery this year is likely to be not only persistent, it’ll most likely accelerate.

3. Profitability of Many* Chinese Companies Will Improve

[*Due to specific circumstances, many new-economy companies won’t participate.]

This is almost a certainty with only the magnitude of the trend moot. The unavoidable circumstance of rising input costs, falling sales or both has led to the shrinkage or evaporation of profits for many.

The services of a CFA Charterholder aren’t required to work out what a reversal of these fortunes will mean for future profitability, and what could surprise is the length of time over which this recovery occurs.

4. Investors Return to Basics

The ultra-low interest rate environment of the last decade created a plethora of homes for investors’ cash and ultra-low interest rates helped a lot of those investments do well; but those days/games are over.

Geared private equity funds, levered bond funds, non-income generating so-called alternative currencies, aggressive stock buy-back programs, flywheel startups, the list goes on of low-rate-liquidity-sinks that’ll no longer be attracting capital.

Already there’s anecdotal evidence that suggests investors are taking a more back-to-basics approach and one of the best performing stocks in the U.S. in the last two years highlights the trend.

Above is the share price chart for agricultural machinery maker Deere & Company (DE). From the low in July 2020 of U$150 (it was lower earlier in the same year) to the close on Friday, February 24th of U$417 the stock price has risen 180%. In 2020 the company’s net profit was U$2.7bn and in 2022 that’d had risen to U$7.1bn, growth of 160%*.

[*Part of the difference between the stock price and income gains is probably a higher valuation. I’ll come on to this potential for China-stocks shortly]

There’s more than a few kicking themselves for missing this ‘old-economy’ growth-in-plain sight opportunity and China has many companies with similar characteristics, but at very different points in the valuation cycle (way lower).

5. Valuations May Rise

If, as the year progresses, China-sentiment improves, the economy presses ahead, corporate profitability rises and investors show more appetite for basic strategies the fifth-element of our catalyzing quintet will show up.

Discussions about valuation of China stocks often stumble on definition so let’s keep this simple. If any of catalysts 1~4 pan out not only will the value (stock prices) of most China stocks rise but the amount investors will be prepared to pay for the same assets, their valuation, will also increase.

This last point is important as it’d end up being the icing on the cake. Whenever this process gets to work, in any market, it’s surprising how much farther it can take asset prices up and away from fundamentals.

Conclusion

Some of the above, most likely, will come to pass; but to what extent these factors trigger a recovery in China-stocks’ fortunes is less certain.

However, with valuations depressed and multiple catalysts on the horizon the case now for China stocks presents significant asymmetric risk. Risk, unequivocally, in investor’s favor.

Nial Gooding

Monday, February 27th 2023