As of December 8th there were 84 Main Board additions in Hong Kong in 2021. One was a listing by introduction and no money was raised but the rest involved subscription.

The average loss i.e. the sum of profits and losses assuming an equal swing at the 83 money-raisers was 16% (to Friday’s close, and throughout).

This compares favorably to some major HK and China indices.

For the year to last Friday the Hang Seng Index was down 12%, the Hang Seng China Enterprises Index was down 20%, the Hang Seng TECH Index was down 28% and the MSCI China ETF (MCHI, a reliable index proxy) was down 19%.

Quite literally then you could have done a lot worse in the space than just punt IPOs for the year.

A Closer Look

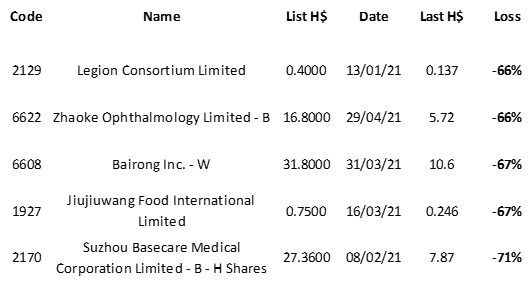

First up, The Lemons:

Now, The Peaches:

Of the total, 20/83 new listings were up from IPO, but the rest were down and 21/83 had produced losses to Friday’s close in excess of 50%.

The data-set is small but there don’t appear to be serial miscreants in terms of who brought consistently bad deals. By the same token there’s nobody that consistently served up Peaches either.

In Conclusion

IPOs, good thing or bad? From an investor’s perspective the answer is simple. Anything that involves the loss of capital in an almost random process is, of course, not something one should be spending time on.

For the companies who listed, their staff, the families that get fed by those staff, the underwriters, the arrangers, the reporting accountants, the HKEX, the printers and the Uncle-Tom-Cobley-and-all of camp-followers involved it was, of course and as always, a very worthwhile activity.

Nial Gooding

Saturday, December 11th 2021