Earlier this year, in a post Considering The Inevitable; and How to Brace for It, I wrote “That large downward corrections (in excess of 50%) in the prices of certain financial assets will take place in due course is in no doubt.”

This process is now underway with China’s so-called ‘edtech’ sector providing a roadmap others will follow.

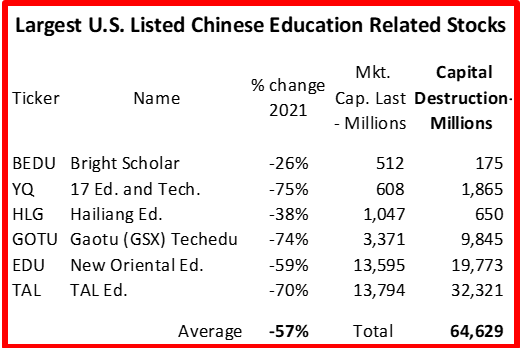

The table below shows the largest U.S. listed companies’ stocks in this group with their price performance for the year to last Friday, July 2nd.

I’ve no interest in dwelling on the reasons for this nor in trying to predict the next iteration. I’d note only that of the six companies above three had failed to turn a profit in 2020 and the combined P/E of the three that did was, as of last Friday, >30x (historic). A rapid recovery therefore is harder to imagine than a continuation of trend.

I followed my February 11th note about inevitability with another, on March 24th (Of Bricks and Wheelbarrows), on how losses from speculative assets were likely to be of the worst i.e. permanent, kind.

You might care to revisit that as I believe permanency will characterize losses in this sector and another useful roadmap laid out in the process.

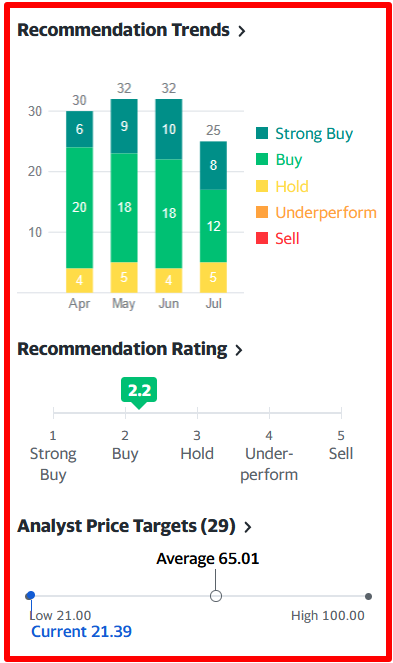

What do the formerly so-noisily-keen now have to say? Inevitably, the booster-community have yet to catch up as the summary below from Yahoo! Finance, snapped last Friday, for TAL shows.

Not a single ‘sell’ recommendation from any of the twenty five no-doubt-sharp minds contributing and a combined target price 200% above Friday’s close. So much for analyst’s recommendation. I’ll make the very easy prediction now about what this group does next.

That revised recommendations with lower price targets will soon begin to cascade in is as certain as the contours of the hat the Roman Pontiff will be sporting at his next formal outing.

The purpose of this note is to highlight what happens to stocks, inevitably, whose prices have been inflated beyond achievable expectation when bad news comes their way. Which it always does.

Most (but probably not all) of the damage has now been done within China’s edtech complex; but there other stocks and sectors, sentimentally related, that have yet to receive comeuppances.

That this will occur is just a matter of time; and we know this because? This is a process in markets as old as time and as predictable as the human condition. To summarize in a word? Inevitable.

Nial Gooding

Monday, July 5th 2021