Just over a year ago JP Morgan issued research, they quickly claimed ‘in error’ (March 2022), that used the word ‘uninvestible*’ to describe Chinese internet stocks.

[*I believe the description correct, but I don’t run a bank whose revenues, in part, are hostage to the favorable opinions of many in the sector.]

Irrespective of the original intention the ‘U’-word gained currency last year as a fig-leaf-justification for the loss-cut-selling by China stock investors which characterized most of 2022.

Weakness early in the year became worse as America and its allies sought to foment the notion that an attack on Taiwan was imminent (it wasn’t) and China bungled its pandemic exit (really, it was).

In short, 2022 was an annus horribilis for China investors and it’s unsurprising sentiment remains fragile today as a result.

The purpose of this note then is not to rake over sad facts of a poor year. Instead, I wanted to take a look at how rapidly China is now recovering; and, in the process, I discovered why 2022-frowns may soon need to be turned upside down.

Below is a summary of recent data points that should begin, at some stage, to positively affect sentiment. That markets have ignored this tide I believe speaks to the depth of the 2022-induced trauma rather than a concern about voracity of any of the assorted series.

So, in no particular order, some good news:

It’s the economy, stupid! China’s planners are aiming to have their economy grow by around 5% this year. Already that target is looking too low. Q1 GDP growth earlier this month, expected at +4%, came in at +4.5% and has prompted a flurry of forecast revisions. The most optimistic I’ve seen so far is from Bank of America who’ve raised their 2023 China GDP growth estimate from +5.5% to +6.3%.

It’s the economy, stupid! II. Prior to the release of China’s Q1 GDP the IMF had published 2023 forecasts with the headline A Rocky Recovery. Much press was given to the global growth target which was cut from +3.4% to +2.8%. Less attention was paid to the China forecast which was unaltered at +5.2%. The IMF had said earlier China will contribute around 30% of global growth in 2023. It must now be more highlighting China’s improving attractiveness/importance in the global context.

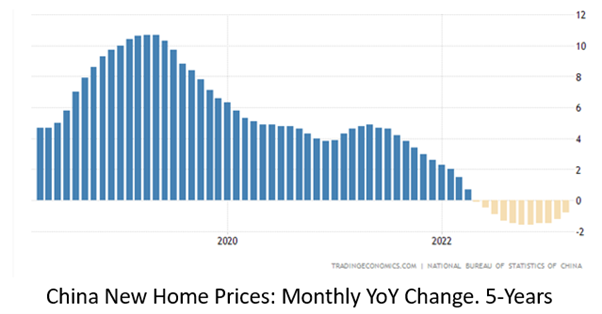

The property market is out of the woods. Problems with developer financing have moved from existential crises to mopping-up operations. More importantly, home prices have stabilized in the major cities. March data recorded the third consecutive monthly rise and the March gain was the highest, at 0.5%, since June 2021. Year on year prices were still down but a look at the trend confirms the generally better picture.

Yes, it’s all falls at the end but in March it was -0.8%, an improvement from -1.2% in February and the trend looks to be locked in.

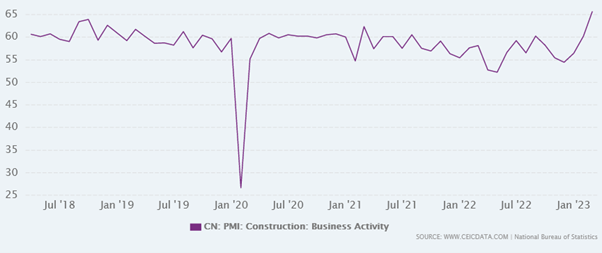

Forward indicators. The construction Purchasing Manager’s Index (PMI) in March was 65.6 and a look at the chart provides context as to how strong that reading was:

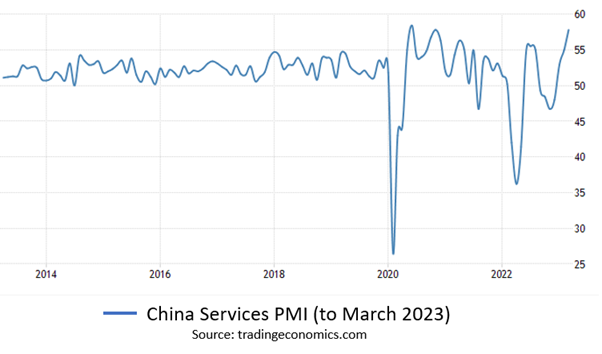

The services PMI, again for March, (below) was also strong. That ‘pop’ at the end is a ten-year high.

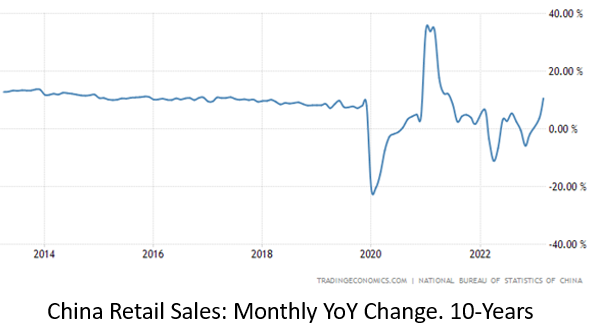

Retail Sales. This series lacks the drama of the two above but is more important as a reading on what’s actually happening rather than what Purchasing Managers would like to be happening. The March reading was +10.6% and is, most likely, more than just a one-off.

Moreover, the chart shows the latest reading taking us back to pre-pandemic levels.

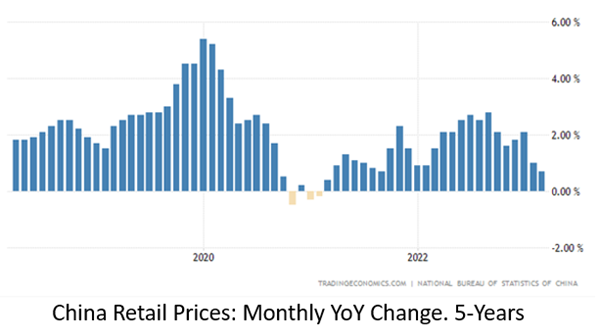

Price Stability. China doesn’t have an inflation problem, for a simple reason. Planners had to wrangle, post the GFC and prior to the pandemic, a more than decade-long bout of inflation caused by over-stimulation in 2008. Confronted with a new economic shock caused by the COVID outbreak they were reluctant to follow the lead of other major economies and spend their way out of the problem, again.

You see the results of this prudence in the chart. Annual inflation in March was 0.7%, in February it was 1% and there seems no sign of a sudden turnaround. Price stability is it’s own good news; but it’s also an essential precursor for a benign..

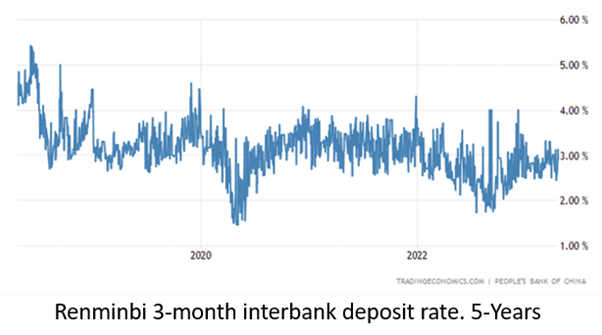

Monetary Policy. Whether it’s multi-year low Loan Prime Rates or the most recent cut to the Reserve Requirement Ratio on March 17th (the latest of fifteen reductions since 2018) monetary policy in China can fairly be described as ‘accommodative’; and is expected to remain so.

This picture has obvious implications for not only healthy business operators going into the recovery but also the walking-wounded in the property sector.

In summary the above indicators, together, paint an unequivocally positive picture of an economy in recovery; but wait, there’s more.

All companies with domestically listed stocks in China are required to publish quarterly results and this process is underway for Q1 as I write.

It’s too soon to provide a summary but the early reads from companies I follow have all been positive, in one way or another. By early next week a comprehensive analysis will be possible and I’ve no doubt, at that time, micro-trends will also be confirmed in a broadly upward trajectory.

That the economic circumstances in China have changed for the better this year is in no doubt. How long will it be before investors change their, now mostly negative, minds in response?

Nial Gooding

Tuesday, April 25th 2023