[The title of this note is a reference to a speech* given by Russell Conwell, founder of Temple University, over six thousand times before his death in 1925. The speech encouraged Philadelphians not to dream of distant riches but find them, via observation and enterprise, in their own backyard. If you substitute ‘Hong Kong’ for ‘Philadelphia’ in the speech it leaves the sense fully intact.]

The purpose of this note is to draw attention to the outstanding value present in Hong Kong listed China stocks or the metaphorical ‘Acres of Diamonds’ now available for investor perusal in the Hong Kong market.

As we head towards a New Year the parlor game of where to invest in 2024 begins and, although partisan, I believe some of the cheapest quality-assets, globally, are to be found among Hong Kong listed companies.

To be clear, I’m talking about legacy businesses run by known-quantity managers that’ve demonstrated multi-year durable business models.

The new-economy cabal can be left alone. None today could be described as ‘legacy’ businesses, managers remain far from known-quantities and, absent in most cases even a decade of stable operation, they can’t correctly be described as multi-year durable.

Stock prices for this group have come down a lot, but gone-down-a-lot is not the same as safe, cheap or nearing a valuation floor. The stocks I want to highlight are, in my opinion, all of these things.

Full disco, I manage The China Dream Absolute Return Fund. This fund invests in Hong Kong listed China stocks. The Fund presently has 18-holdings and of course I believe these are the top-picks from the c. 300 or so investable stocks listed in Hong Kong.

NONE of the stocks flagged below are held by the Fund, which is sort of the point. Valuations in the Hong Kong market are so extreme presently and quality so ubiquitous I’m spoilt for choice. The distinction between Fund holdings and some stocks mentioned may be a valuation or qualitative hair’s breadth. Or in some cases, with limited resources, I’ve had to make a pick in a sector and invested time in one or other prospect but could just as well have picked a featured near-peer.

Below I’m highlighting seven sector representatives and will follow the specifics with an aggregate look at what the characteristics of a portfolio composed of those names would be.

In no special order, sectors represented are: finance, utility, property, industrial, energy, consumption and export manufacture. If you’ve an interest in other sectors you’re welcome to rummage on your own. I guarantee, you’ll find great value there too.

So, let’s get to specifics. Starting with:

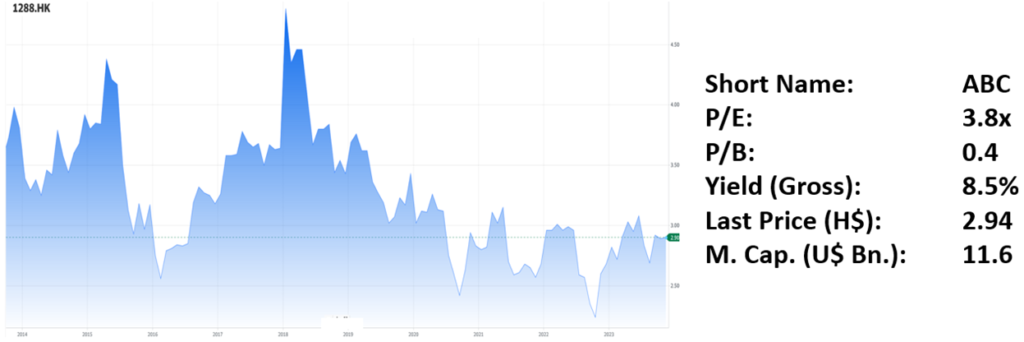

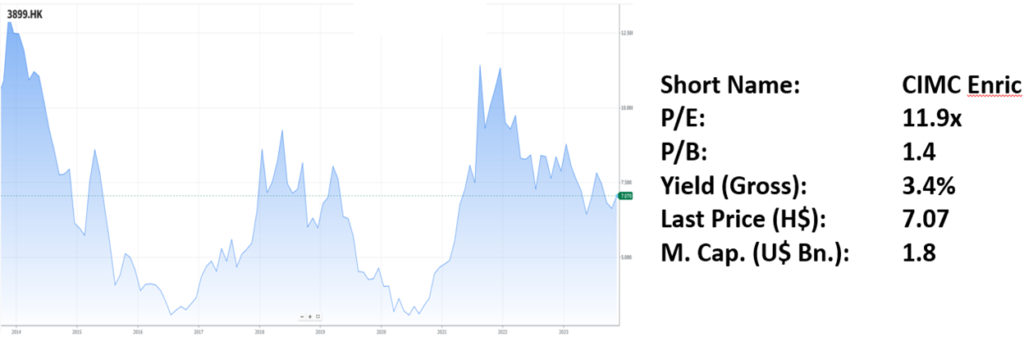

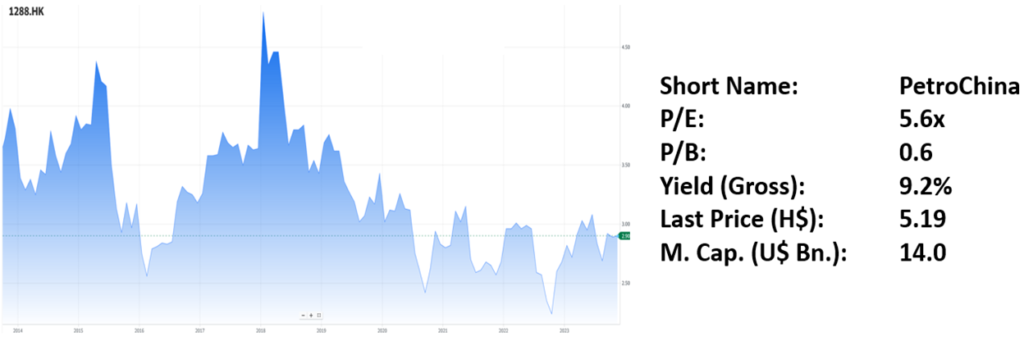

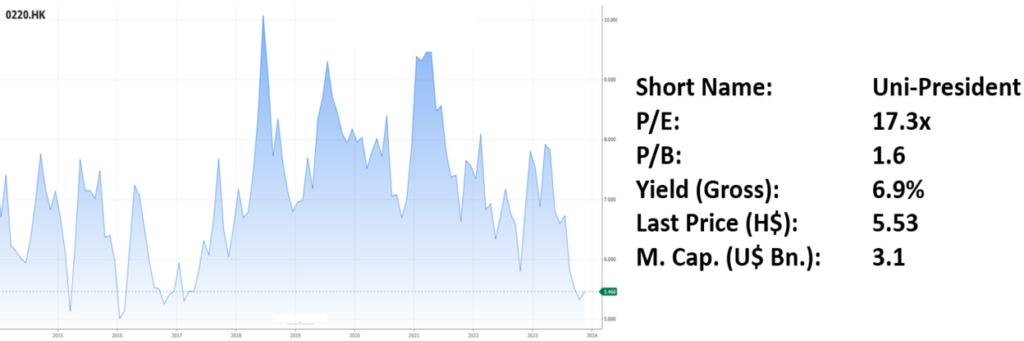

[All charts are for 10-years, source: yahoo!finance. Price and valuation data: Hong Kong Stock Exchange and aastocks.com. Market cap. data is for the Hong Kong quote only.]

Finance: Agricultural Bank of China (01288)

Utility: China Mobile Limited (00941)

Property: China Vanke Co. Ltd. (02202)

Industrial: CIMC Enric Holdings Limited (03899)

Energy: Petrochina Company Limited (00857)

Consumption: Uni-President China Holdings Limited (00220)

Export Manufacture: VTech Holdings Limited (00303)

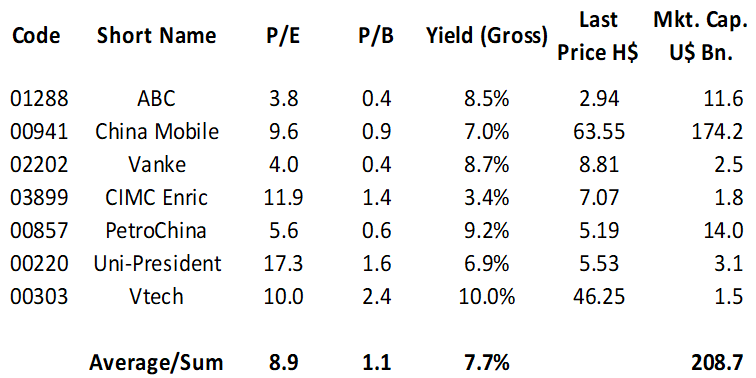

A portfolio composed of these seven stocks would look as follows:

This selection of (almost) random names, all at or close to historic valuation lows is now offered at a book value of 1.1 with a P/E under 9x and a gross yield close to 8%. Moreover, this is historical data which takes no account of potential future growth.

You can quibble individual names, but if you take a closer look at the sectors represented you’ll find many other high quality names in the same space on equally low historic valuations.

Don’t like Uni-President as a consumer play? Fine, how about Li-Ning (02331, recently crushed), Hengan (01044, just off 10-year lows) or Beijing Airport (00694, a recovery story if ever there was one)?

To elaborate a point above, I’m not trying to ‘pick’ stocks or make recommendations. I’m trying to show, by example, what a target-rich environment the Hong Kong stock market is for investors looking for a low-cost entry into the world’s second largest economy. One that will undoubtedly maintain growth momentum through next year.

I can’t remember a time in over 30-years of close acquaintance when opportunities in the Hong Kong market were in such abundance and offering such outstanding value. You must do your own diligence and select stocks you’re comfortable with; but I’m sure, whatever your selection criteria, you’ll find things to like if you’d care to look.

Prospect elsewhere, by all means; but before you begin to vex about how hard it is to find good homes for capital I’d like to make sure you’re aware of the in-plain-sight ‘Acres of Diamonds’ present now in Hong Kong.

Nial Gooding

November, 23rd 2023