Summary conclusion

The outlook for the US economy is the outlook for the global economy. It’s therefore, in large part, the outlook for China’s. Given the recent sturm und drang commentary from the US I thought a quick look at underlying reality was in order. What I found was not only reassuring but suggests, to me at least, the stage is set for more upward progress in the next couple of years.

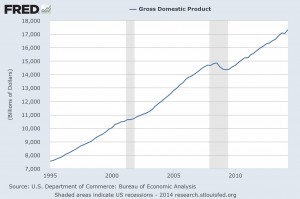

First; GDP

The tiny blip down at the end is the Q1 number which we know is now more than being made up. In short what’s clear is that the American economy has never been bigger i.e. Americans in aggregate have never been richer than today. Moreover, we can get sidetracked with discussions about output gaps and the like but given historical precedent (also clear above) I think a betting person would be reluctant to wager on this line heading down in the next couple of years. Guessing the rate of progress is a fun parlor game for talking heads but what matters to most of us is that this line continues upwards. Which, it seems, it is.

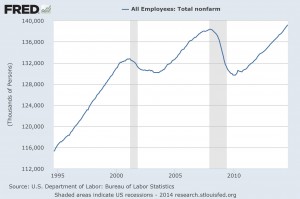

Next; employment

There are really only two series in the US you need to keep an eye on if you’re a stock investor. This one and the one I’ll come onto next. This is the total number of salary earners and I like it because unlike the unemployment rate which lends itself to fussy analysis this is a more workmanlike assessment of labor market conditions. We recently surpassed the previous peak and the most recent data shows persistent momentum. Not only does the US economy contain more salaried individuals than ever before, the vast majority of them will be sharing a portion of their new found good fortune with Uncle Sam by way of taxes.

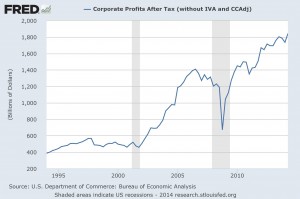

Now; corporate profits

Of course, in the short run there’s no reliable relationship between stock prices and earnings; but without profits there can be no investment and that would be a problem; but look above. That’s the total number of dollars earned by US companies and it’s never been higher. There are many ah-buts that this number stirs up. The most common being gains are all post GFC windfall effect as suppressed wages and low investment mean that top line gains have rattled quickly to the bottom line. Perhaps; but there seems no sign of this momentum flagging and if it persists stock prices will surely, eventually, be dragged along in its wake.

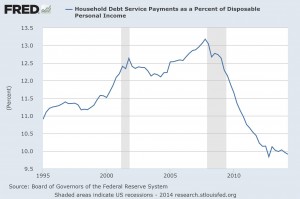

Consumers; a coiled spring?

That households have de-geared since the GFC isn’t news; but the extent of this may be a surprise to some? All the charts above are for the last 20-years but this series goes back to 1979 and where we are today is only 10bp away from the all-time low of Q412 (now 9.9%, then 9.8%). This is a doubly magnificent achievement as not only has the household debt burden been reduced since 2007 but also this has occurred while real wage growth has been comparatively sluggish. What I read from this is when the consumer is ready to come out from their collective shell there’ll be no shortage of firepower for delayed consumption gratification.

Corporate balance sheets?

There’s been scaremongering recently along the lines that US companies are binging on cheap credit with nothing better to do than buy back their own stock. Sure, there’s something to this; but the big charge that there’s balance sheet deterioration at the heart of corporate America isn’t true. The gauge I’m using here to illustrate my point has weaknesses but I think is a good real world summary of leverage risk. As you can see also, as we went into the GFC balance sheets in aggregate were in fine shape to begin with. There’s therefore little to fear from higher rates and, like consumers, plenty of dry powder for future spending.

In conclusion

Honestly, I didn’t start with a conclusion and set about proving it.

I merely wanted to see what truth could be sought from facts and what I find is encouraging. The US stock market is taking a well earned rest after some splendid work in recent years but I don’t believe it’s a harbinger of a reversal of broad underlying economic progress. Yes, most of what I’ve highlighted is history and investors need to live in the future; but the trends highlighted appear to be of sufficient strength to make it a low risk bet assuming they’ll most likely persist?

Good news then for the US, good news for the world and good news for our part of the world I’ve no doubt; in due course.